Can DEX Boom Save Cardano? ADA Seeks Recovery As Trading Activity Surges

Cardano (ADA), the smart contract platform, has been facing a rough patch recently. While the broader DeFi sector has seen an uptick in DEX volumes, Cardano’s Total Value Locked (TVL) has plummeted, raising concerns about the health of its ecosystem.

DeFi Activity And NFT Market Slump

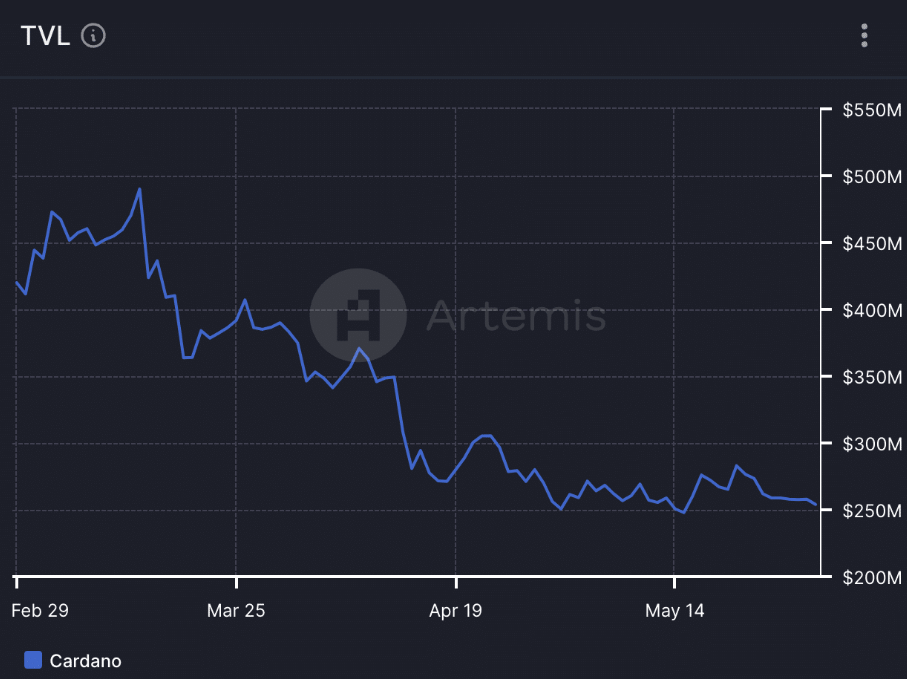

Despite the surge in DEX volumes across the crypto landscape, Cardano’s TVL has witnessed a significant decline, dropping from $430 million to $230 million, according to data from Artemis, a leading blockchain data provider. This suggests a lack of interest in dApps built on the Cardano network, potentially hindering its long-term growth prospects.

The NFT space on Cardano has also taken a hit. Popular NFT collections have seen a dramatic decrease in floor price and overall trading volume over the past month. This waning interest in Cardano NFTs could further dampen investor sentiment and negatively impact the price of ADA.

Cardano: Technical Indicators Flash Warning Signs

The technical outlook for ADA is currently bearish. The price has been trending downwards over the past few weeks, forming multiple lower lows and lower highs. Additionally, key technical indicators like the RSI (Relative Strength Index) and CMF (Chaikin Money Flow) are pointing towards declining bullish momentum and money flow into ADA.

Beyond the immediate price and DeFi woes, other factors raise concerns about Cardano’s future. The velocity of ADA, indicating the frequency of token exchange, has fallen significantly, suggesting decreased trading activity. Additionally, the MVRV ratio, a measure of profitability for token holders, has also dropped, implying that most ADA addresses are currently underwater.

Cardano Price Forecast

While Cardano remains a prominent player in the blockchain space, the recent developments highlight the challenges it faces. The combination of declining price, waning DeFi and NFT activity, and negative on-chain metrics suggests a potential for further downside in the short term.

Cardano is expected to experience a modest increase in price, reaching $0.47 by June 30, 2024, indicating a predicted rise of nearly 5%. However, it’s important to consider various technical indicators and market sentiment to assess the potential movement of the asset.

The crypto’s bearish sentiment may be influenced by factors such as market trends, news events, or technical analysis patterns. Additionally, the Fear & Greed Index stands at 73, indicating a state of Greed among market participants. This suggests that investors may be more inclined to take risks or engage in speculative behavior, which could potentially impact Cardano’s price movement.

It’s noteworthy that ADA has experienced significant price fluctuations in the past. Its highest price of $3.10 was reached on September 2, 2021, marking its all-time high, while its lowest price of $0.017 was recorded on October 1, 2017, representing its all-time low. These historical price points highlight the volatility and potential for significant price swings within the Cardano market.

Featured image from ReddSparks Crypto Blog, chart from TradingView

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings