Institutional Investors Triple Their Exposure to Ethereum Ahead of the ETH Spot ETF According to Bybit

Bybit, one of the leading cryptocurrency exchanges, recently revealed that its institutional investors have tripled their exposure to Ethereum in anticipation of the upcoming ETH Spot Exchange Traded Fund (ETF) launch.

Key highlights:

Bybit's institutional investors have significantly increased their ETH holdings.

The upcoming ETH Spot ETF launch is expected to boost Ethereum's market value.

Both institutional and retail investors are showing increased interest in Ethereum.

What is an ETF?

An ETF is a type of investment fund and exchange-traded product that is traded on stock exchanges, much like stocks. The announcement of the ETH Spot ETF is a significant event for Ethereum and the broader crypto market because it provides a regulated and accessible way for investors to gain exposure to ETH, even institutional investors.

6 Best Growth ETFs to Buy

Market reaction on Spot Bitcoin ETF approval

The market's reaction to the approval of the Spot Bitcoin ETF was highly positive. with Bitcoin's price seeing a substantial increase.

This approval set a precedent and boosted investor confidence in cryptocurrency ETFs. Similarly, the approval of the Gold ETF in the past led to a significant rise in gold prices. The availability of such investment vehicles can positively impact asset prices by making them more accessible to a broader range of investors.

Bitcoin vs Bitcoin ETF

Impact on institutional and retail investors

Institutional investors have shown a marked increase in their allocation to Ethereum. Bybit reports that these investors have tripled their ETH holdings, demonstrating growing confidence in Ethereum's potential.

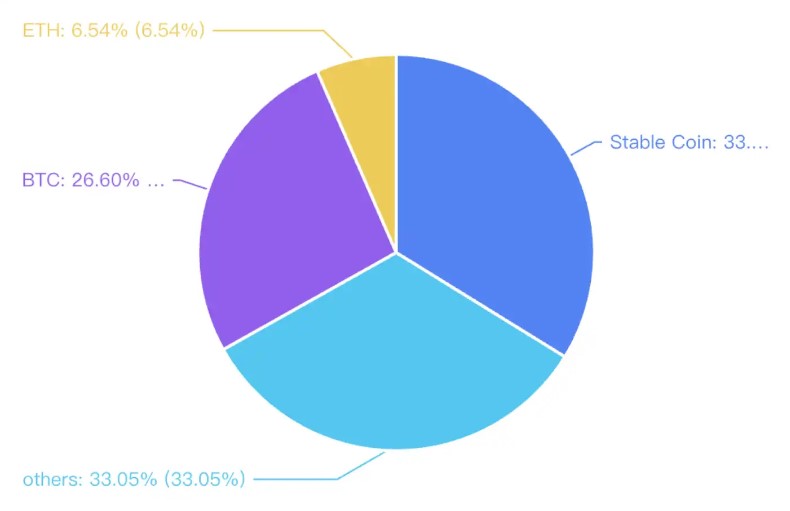

Institutional Investor Allocations Before ETH ETF Announced (source: Bybit)

Institutional Investor Allocations Before ETH ETF Announced (source: Bybit)

This shift in allocation is driven by the anticipation that the ETH Spot ETF will attract even more investment into Ethereum, positively affecting its price and market capitalization. Institutional investors typically seek stability and long-term growth, and their increased exposure to ETH suggests a strong belief in its future performance.

Retail investors (non-institutional traders) are also showing increased interest in Ethereum. The announcement of the ETH Spot ETF has made Ethereum more attractive to individual investors who may have been hesitant to invest in cryptocurrencies. The ETF offers a simplified and regulated way to invest in ETH. As a result, the increased demand from both institutional and retail investors is expected to drive up the price of the second-largest cryptocurrency.

Conclusion

Bybit's report shows that institutional investors have tripled their ETH exposure after the announcement of Ethereum spot ETF. The increased interest is shared by retail investors as well. The ETF provides a regulated and accessible way for a wider range of investors to invest in Ethereum, which is expected to boost its market value significantly. This development should mirror the positive impact that was recoded with the approval of the Gold ETF in the past, and Bitcoin ETF earlier this year.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings