‘Fundamental Shift’ in Traditional Bitcoin Market Cycle May Be on the Horizon

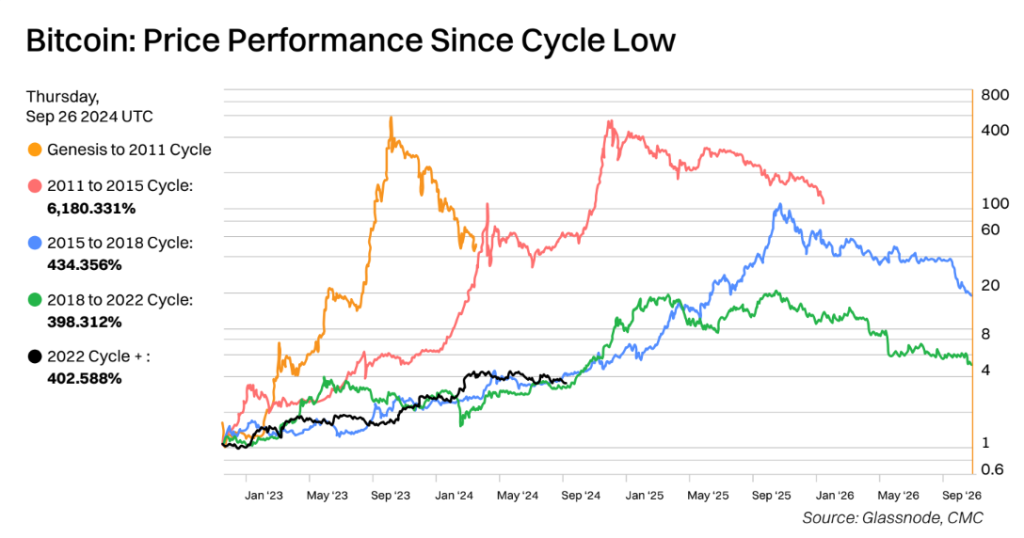

There may be a shift coming in the traditional Bitcoin market cycles, as current trends outpace historical patterns, according to the latest CoinMarketCap’s Quarterly Report.

The Q3 report found that the bull market progress is at 40.66%.

Typically, it says, based on historical patterns, bull markets peak 518-546 days after a halving event.

The most recent Bitcoin halving occurred on April 19, 2024.

However, the report found that Bitcoin is ahead of the typical market peak by about 100 days.

This means that a peak may be occurring “significantly earlier than expected,” between mid-May and mid-June 2025.

There are, however, some indications of the evolving broader market dynamics. Primarily, the infrastructure growth is slowing down.

The report noted that this may be an anomaly or the beginning of a longer-term change in market behavior.

It remains to be seen if BTC “will continue to follow historical patterns, or [we are] witnessing a fundamental shift in the crypto cycle,” it said.

Source: CoinMarketCap

Furthermore, a number of signs are pointing to a potential break in Bitcoin’s traditional four-year cycle.

Specifically, it may be entering a so-called ‘super cycle’ “driven by institutional adoption, ETFs, and changing market dynamics.”

According to the Bitcoin Super Cycle theory, BTC’s price will continue to surge indefinitely against the traditional four-year market cycles that have characterized its price history.

The Correlation with Traditional Assets is another indicator. BTC price movements are progressively correlated with gold and tech stocks, meaning the asset is getting integrated deeper into general financial markets.

“This correlation indicates that Bitcoin is being treated more like a traditional financial asset, potentially breaking its isolated four-year cycle,” the press release said.

Additionally, the profile of BTC investors has “shifted dramatically.” There is a notable and growing institutional adoption.

You might also like

Bitcoin’s Path to a Supercycle: Will 2024 Mark the End of Dramatic Downturns?

Q3 Saw Bears, But Q4 Could See Bulls

The report further looked into the coin’s performance in the third quarter of this year.

It described it as “mixed.” Negative returns of 8.6% in August were “sandwiched between modest gains” in July (2.95%) and September (11.39%).

Also, the Q3 Market sentiment was consistently bearish.

Yet, the bearish trend was expected in this period, as suggested by historical data.

But the same data shows that the fourth quarter could see a turnaround.

Over the past decade, October has averaged 22.9%, said the report.

November and December have also recorded positive returns, with 46.81% and 5.45% averages, respectively.

Additionally, the year’s earlier quarters have already recorded “strong performances.” February and March saw 43.55% and 16.81% gains, respectively.

Source: CoinMarketCap

The report stressed that “past performance doesn’t guarantee future results.”

However, it said, “the combination of historical Q4 strength and 2024’s overall bullish trend suggests Bitcoin may be poised for a robust finish to the year, despite Q3’s bearish indicators.”

Meanwhile, 19 out of 52 sectors saw positive growth in market capitalization over the third quarter.

The “most prominent sectors for growth” were the TRON ecosystem, Media, and Stablecoins have been the most.

The AI sector also experienced a notable recovery in this period.

“There seems to be a shift from DeFi and infrastructure projects towards more speculative and consumer-focused sectors like AI, media, and memes in the past quarter,” the report concluded.

You might also like

Anthony Pompliano: Bitcoin Ready for Gains as Interest Rates Fall and Liquidity Grows

The post ‘Fundamental Shift’ in Traditional Bitcoin Market Cycle May Be on the Horizon appeared first on Cryptonews.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings