12 Best Crypto to Buy Now in July 2024

With the cryptocurrency markets still in an uncertain position, many crypto investors are wondering if it’s time to sell in order to secure their profits, or continue to hold, or even accumulate, to benefit from a potential price rally that could be in the store in the short to medium term.

Even though the crypto markets have always recovered from their bearish periods so far, every bear market has its “casualties” that never make a strong recovery. Therefore, it’s important to choose quality crypto projects that have a good chance of surviving the bear market and thriving in the future.

We’ve analyzed 200 of the top cryptocurrencies based on their liquidity and availability, technology, sector leadership, tokenomics and more key factors. You can read more about our criteria a bit further down in the article.

By doing so, we’ve narrowed the list down to a dozen cryptocurrencies that present the most compelling opportunities at the moment. The top three coins on our list are updated weekly to reflect the most up-to-date developments in the crypto and blockchain sector.

List of the best cryptocurrencies to invest in July 2024:

Bitcoin – Decentralized peer-to-peer cryptocurrency

Fetch.ai – Leading AI-focused crypto project

Ethereum – The leading blockchain for smart contracts

Solana – High-performance blockchain platform for smart contracts

Kaspa – Scalable layer1 blockchain based on BlockDAG architecture

Toncoin – A blockchain closely integrated with the Telegram messenger

BNB – A popular cryptocurrency utilized in the Binance ecosystem

XRP – Highly efficient digital currency

Uniswap – The biggest DEX on Ethereum

Cosmos – A network of interoperable blockchains

Shiba Inu – The second-largest meme coin on the market

Arbitrum – The leading layer 2 in the Ethereum ecosystem

Examining the best cryptos to buy right now

Let’s start off by highlighting three cryptocurrency projects that have seen important developments recently or have big events coming up in the near future. We update these highlighted coins on a weekly basis to reflect the latest developments in the world of crypto and blockchain.

Before we dive into our list of the best cryptos to buy, we should note that choosing which crypto to buy is only the first step in your crypto investment journey. It's also important to choose the right platform to buy crypto, and you also have to decide how you will be storing your cryptocurrency.

In our opinion, the best way to invest in crypto is to transfer your coins to a hardware wallet after you buy it on an exchange. A great starting point is to buy cryptocurrency on KuCoin and store it in a Ledger hardware wallet.

1. Bitcoin

Bitcoin is a decentralized peer-to-peer cryptocurrency that was initially described in 2008 and launched in early 2009. Bitcoin was invented by a person using the pseudonym Satoshi Nakamoto, whose real identity is still unknown.

Bitcoin introduced the concept of a blockchain and provides a fully decentralized digital currency that’s extremely secure. It implements Proof-of-Work to make it very difficult to alter the history of transactions or double spend coins. The network is secured by miners, who are rewarded with BTC coins for adding blocks to the Bitcoin blockchain.

BTC can be sent anywhere in the world on a 24/7 basis, and transactions cannot be blocked by any intermediaries. By holding their own private keys, users can self-custody their Bitcoin without requiring institutions such as banks.

Even though countless cryptocurrencies and blockchain platforms have been released after Bitcoin, BTC is still easily the largest cryptocurrency by market capitalization.

Why Bitcoin?

Bitcoin has managed to hold above the $55,000 price level despite a brief dip to $54,000 at the middle of last week. The world’s largest cryptocurrency advanced towards $57,800, which is where it is holding at the time of writing this article.

Recently, governments have been moving their BTC holdings, which has been a significant driver of price action for Bitcoin. On June 26, a wallet controlled by the U.S. Government moved roughly $240 million worth of BTC seized from a Silk Road dark web marketplace vendor to Coinbase.

UPDATE: Mt. Gox moving $2.71B BTC

In the past 8 hours, Mt. Gox wallets moved 47,229 BTC ($2.71B) from the cold wallet 1HeHL.

2701.8 BTC ($148.4M) was moved out of Mt. Gox wallets with 1544.7 BTC ($84.9M) sent to Bitbank through Gox address 1PKGG, and 1157.1 BTC ($63.6M) sent to… pic.twitter.com/sJEuJB7GwC

— Arkham (@ArkhamIntel) July 5, 2024

Even more importantly, creditors of the failed Mt. Gox exchange have started receiving their BTC after years of legal limbo. In total, about $9 billion worth of BTC will be distributed to creditors, sparking concerns about a huge wall of supply that could drive prices lower in the short term. So far, wallets associated with Mt. Got have moved 47,229 BTC.

The German government has also been busy with their seized Bitcoin in recent weeks, moving tens of millions of dollars worth of the cryptocurrency to various exchanges including Coinbase, Kraken and Bitstamp.

While these developments will likely negatively impact the price of BTC in the short term, it could be argued that they’re good for Bitcoin overall. Mt. Gox repayments were always going to happen, and it could easily be argued that governments lessening their grip over BTC is also not a bad thing. If that means lower prices in the short term, so be it. Also, large institutional sell orders will undoubtedly significantly impact prices, which could provide savvy investors with ample trading opportunities for buying the dip and selling local tops.

2. Fetch.ai

Fetch.ai is a platform focused on leveraging artificial intelligence (AI) and blockchain technology to empower scalable and interoperable solutions in various sectors. It enables the creation of decentralized digital entities, termed "autonomous agents," which can perform a range of tasks, from optimizing supply chains to facilitating data trading.

Fetch.ai's technology integrates AI, machine learning, and blockchain, fostering an environment for the emergence of the "Economy of Things," where agents autonomously interact and transact. The platform's ecosystem promotes innovative applications in fields like mobility, IoT, and data sharing, aiming to simplify and enhance processes through AI-driven solutions.

Why Fetch.ai?

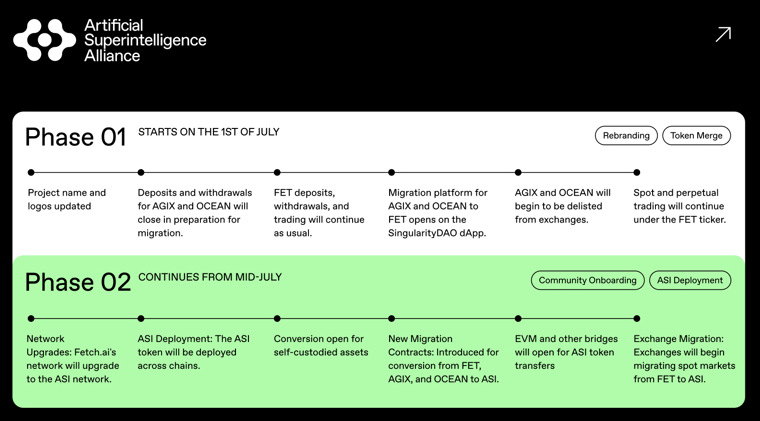

The process that will see SingularityNET, Ocean Protocol, and Fetch.ai merge into a new token called Artificial Superintelligence Alliance (ASI) has begun. The process is split into two phases. In the first phase, which is already underway, AGIX and OCEAN have merged with FET, creating the largest AI-focused crypto ecosystem. The second phase, slated for mid to late July, will see FET migrate to ASI at a 1:1 ratio.

Roadmap for FET, AGIX, and OCEAN’s migration process to a new token called ASI. Image source: Artificial Superintelligence Alliance

The unification of the three tokens under the Artificial Superintelligence Alliance umbrella will allow the projects to pursue the “vision of a decentralized, efficient, and transparent AI landscape.” According to the official statement, the projects will pool resources and expertise from one another to accelerate the development of blockchain-based AI solutions.

Cryptocurrency exchanges have already started delisting OCEAN and AGIX from their spot markets and will continue to do so in the coming days and weeks.

The merger could provide trading opportunities for investors, both short and long-term. Artificial Superintelligence Alliance will undoubtedly become the driving force in the crypto AI landscape. If the AI growth trend continues at the pace we’ve seen over the past year or so, ASI could become one of the largest crypto projects in the world.

3. Ethereum

Ethereum is a blockchain that supports smart contracts, enabling more complex use cases such as decentralized lending protocols and non-fungible tokens. The Ethereum project was founded by Vitalik Buterin, who published the Ethereum whitepaper in late 2013. The Ethereum blockchain launched in July 2015.

One of the first use cases enabled by Ethereum that gained a lot of traction was the ability to issue custom tokens that could be transacted over the Ethereum blockchain. This feature was utilized by many projects to conduct fundraising through Initial Coin Offerings (ICOs) and other types of token sales.

Today, Ethereum has an extremely vibrant ecosystem of decentralized applications – including decentralized financial services, NFT marketplaces, publishing platforms, decentralized cryptocurrency exchanges, and more – which makes it a good investment in 2023, in our opinion.

ETH is the native asset of the Ethereum blockchain, providing an incentive for users to secure the network. The Ethereum network originally implemented a Proof-of-Work consensus mechanism but switched over to Proof-of-Stake in September of 2022.

Why Ethereum?

With Ethereum ETFs expected to start trading in the US market soon, ETH is certainly among the most interesting crypto assets to keep an eye on in the short term.

After the SEC’s approval of 19b-4 filings from exchanges that are looking to list Ethereum ETFs, ETH saw a substantial rally that took the ETH price to roughly $3,900. Since then, the price has dipped into the $3,000 range. However, once ETFs actually start trading, we could see another doze of bullish activity take over the ETH markets.

Remember that the first Bitcoin spot ETFs started trading in the US just earlier this year. When they first launched, BTC was trading at about $45,000. However, in the days and weeks following the launch, BTC shot up all the way to a new all-time high above $73,600.

While it’s impossible to say whether spot ETFs will have the same outsized impact on ETH as they did on BTC, it’s difficult not to be at least somewhat optimistic about the whole thing. According to the latest news coming from Bloomberg analysts, the SEC could approve Ethereum spot ETFs for trading on July 15th.

4. Solana

Solana is a smart contracts platform with a unique architecture that allows it to process thousands of transactions per second while keeping costs extremely low. Solana achieves this by utilizing a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL is among the cheapest cryptos to transfer on the market, as users pay less than $0.001 per transaction on average.

Solana was founded in 2018 by Anatoly Yakovenko. The platform’s mainnet launched in March 2020 and saw a huge boost in adoption in 2021. While SOL has lost a lot of its value in the 2022 bear market, Solana still has one of the most impressive ecosystems in the cryptocurrency sector and is potentially still one of the next cryptos to explode.

Why Solana?

There have been two separate applications to launch a spot Solana ETF in the United States, coming from asset management firms VanEck and 21Shares. Both applications are seeking to get the products listed on the CBOE BZX exchange.

21Shares files for permission to offer ETF linked to cryptocurrency Solana https://t.co/3f0yn7SU4M pic.twitter.com/fo2QnABovv

— Reuters (@Reuters) June 28, 2024

21Shares plans to use Coinbase as the fund’s SOL custodian, with the funds being stored in segregated wallets on the Solana blockchain. Notably, the fund will not be staking SOL, likely due to regulatory requirements.

Outside of the United States, 21Shares already offers an ETP (exchange-traded product) that is 100% physically backed by SOL. The product also gives holders access to staking yields. The product, which has the ticker ASOL, trades on the SIX Swiss Exchange, Boerse Stuttgart, and Euronext Amsterdam stock exchanges.

While the fact that there are now active Solana ETF applications is bullish for SOL overall, the path to a Solana ETF might be more difficult than what we’ve seen with the recently approved Ethereum ETFs.

It’s important to note here that U.S. securities regulator SEC has already claimed that SOL is an unregistered security in at least two lawsuits. Meanwhile, U.S. regulators largely treat Bitcoin and Ethereum as commodities. Another factor to consider is that, unlike Bitcoin and Ethereum, there is no regulated Solana futures market in the United States.

5. Kaspa

Kaspa is a decentralized cryptocurrency project focused on high scalability and fast transactions. Utilizing a blockDAG rather than a traditional blockchain, Kaspa aims to offer fast block confirmations for a more efficient and user-friendly experience.

The layer-1 blockchain makes GPU mining processes more efficient, combining a proof-of-work (PoW) consensus mechanism with a DAG (directed acyclic graph) to optimize block finality. This makes the Kaspa network more efficient than alternative PoW chains, not just in terms of energy expenditure for miners, but also in terms of processing transactions.

Why Kaspa?

Kaspa was one of the best cryptocurrency performers last week, gaining 19.5% against the US dollar in the seven-day period.

Arguably the biggest catalyst for this growth was the news that cryptocurrency mining firm Marathon Digital announced that it had been mining Kaspa since September 2023.

The company has purchased 60 petahash worth of Kaspa mining hardware (Bitmain’s KS3, KS5, and KS5 Pro miners), although only half of Marathon Digital’s Kaspa miners are operating at the moment. The firm estimates that it will have 16% of Kaspa’s global hashrate once all its Kaspa mining hardware is deployed.

For even more context on Kaspa, as well as how we continue to support Bitcoin and proof-of-work ecosystems, read our blog for more details: https://t.co/6MxgVxowEa

— MARA (@MarathonDH) June 26, 2024

Marathon cited Kaspa’s “fair launch, technology and strong market position” as the main reasons why they decided to start mining it in addition to Bitcoin. The company also said that diversification of its digital assets portfolio was a key reason for launching Kaspa mining operations. It's worth noting that KAS is the most profitable crypto to mine as of July.

Marathon Digital’s chief growth officer Adam Swick stated:

“Integrating Kaspa into our digital asset compute portfolio enables us to diversify our revenue streams and improve our profitability per kilowatt-hour. Bitcoin is Bitcoin, and nothing will ever take away its unique value proposition. However, Kaspa's innovative technology and dedicated community present a valuable opportunity for us to support and nurture proof-of-work innovation.”

6. Toncoin

Toncoin is a blockchain project that’s continuing the development of a blockchain platform that was initially designed by the team behind the Telegram messenger. While Telegram was forced to abandon the project due to legal trouble with securities regulators in the United States, community members saw potential in Telegram’s blockchain vision and resumed development under the name Toncoin.

The development of Toncoin is led by an organization called the TON Foundation, which has no formal association with Telegram. However, the Telegram team is integrating various solutions powered by the Toncoin blockchain into their messenger. For example, the Telegram app now allows users to access the TON Space wallet.

From a technical perspective, Toncoin is a scalable blockchain with smart contracts functionality and a Proof-of-Stake consensus mechanism. However, the initial distribution of TON was performed through a Proof-of-Work model to ensure a fair launch.

Why Toncoin?

According to a report by The Block, cryptocurrency investment firm Pantera Capital is in the process of raising capital for a fund that will be focused on investing in Toncoin. The fund is looking for investments of at least $250,000 from each backer.

Pantera Capital appears to be highly bullish on TON, as the firm said in a newsletter published in May that its investment in TON was its largest investment ever. The new TON investment opportunity currently being explored by Pantera appears to be a way to double down on that bet. Ryan Barney, a partner at Pantera, had the following to say about Toncoin and the TON Blockchain:

“Given its vast user base, scalable infrastructure, a thriving ecosystem of mini apps, and native stablecoin transactions, TON taps into the potential of a network with 900 million active, engaged users.”

After the viral success of Notcoin’s clicker game and the project’s NOT token launch, we’re seeing surging activity on Telegram mini-apps that follow a similar blueprint. Some examples of Telegram mini-apps that have achieved substantial traction include Hamster Kombat, Catizen, Yescoin, TapSwap and Gemz. Many such games are planning to launch tokens on the TON Blockchain, which could help grow the platform even further.

New Telegram games like 'Hamster Kombat' show the search is on again for a 'killer app' in crypto, @MuyaoShen writes in the Bloomberg Crypto newsletter https://t.co/lZwIbNeWFg

— Bloomberg Crypto (@crypto) June 11, 2024

7. BNB

BNB is a token that was launched by the Binance cryptocurrency exchange in 2017. BNB serves two primary functions. Holders of the token get access to special benefits when using Binance – this includes lower trading fees, access the exchange’s Launchpad and Launchpool programs, cashback on Binance Visa card purchases, and more.

The token is also used as the native asset of the BNB Chain blockchain. BNB Chain is a variant of Ethereum that offers significantly lower transaction fees to users, and it allows developers to easily deploy EVM-compatible decentralized applications. Previously known as Binance Coin, BNB has now gone through an extensive rebranding.

Why BNB?

The Binance cryptocurrency exchange recently announced a new initiative called “HODLer Airdrops”, which will provide airdrops to users who have their BNB tokens in Binance’s Simple Earn lending products.

According to Binance, the tokens that will be airdropped through HODLer Airdrops will be sourced from projects that already have a large circulating token supply and will soon be listed on Binance. The exchange says it will be prioritizing “small to medium projects with strong fundamentals, a large circulating supply, and strong and organic communities”.

HODLer Airdrops will apply to BNB holders who have their tokens in Simple Earn products, including flexible and locked lending products. The airdrop allocations will be determine according to each user’s hourly average balance in Simple Earn, and Binance will also be taking historical snapshots of users’ Simple Earn BNB balances at randomly selected intervals.

The HODLer Airdrops initiative is yet another incentive for users to hold BNB tokens, as BNB tokens committed to Simple Earn products will also be eligible for other benefits such as Launchpool and Megadrop initiatives, as well as Binance’s VIP program.

8. XRP

XRP is a cryptocurrency that was launched in June of 2012. It was developed by David Schwartz, Jed McCaleb and Arthur Britto, who started a company called OpenCoin together with Chris Larsen. 80% of the XRP supply was gifted to the company by the developers of XRP. OpenCoin has since been renamed to Ripple, and the company has put the majority of its XRP holdings into escrow.

XRP provides very fast and low-cost transfers, making it suitable for use-cases like remittances. It uses neither Proof-of-Work nor Proof-of-Stake, but instead implements the XRP Ledger Consensus Protocol. Every participant in the XRP network can choose a set of validators that they trust to behave honestly.

Ripple has implemented the XRP cryptocurrency into its products, most notably On-Demand Liquidity (ODL). ODL works in partnership with cryptocurrency exchanges uses XRP to provide efficient cross-border money transfers.

Why XRP?

US fintech firm Ripple, which is the key player in the XRP Ledger ecosystem, has announced that they will be launching a new dollar-pegged stablecoin on the XRP Ledger and Ethereum platforms. The stablecoin will follow the traditional model of full backing using USD deposits, (short-term) US government treasuries and other cash equivalents.

To increase transparency, Ripple aims to publish monthly attestations conducted by a third-party accounting firm to demonstrate that the stablecoin is fully backed.

David Schwartz, Ripple’s CTO and one of the original architects of the XRP Ledger, said that a USD-backed stablecoin on the XRP Ledger platform will be a “gamechanger” for both users and developers.

A high-quality USD stablecoin on the XRPL – with its decentralized exchange and features like issued currencies, auto-bridging (that uses XRP as the native currency to facilitate trades between other assets), and the AMM — will be a gamechanger for users and devs. https://t.co/uGC72bosfM

— David "JoelKatz" Schwartz (@JoelKatz) April 4, 2024

XRP investors can look forward to the stablecoin potentially boosting liquidity on the XRP Ledger’s built-in decentralized exchange functionality and introduce new cases for the XRP Ledger platform, which could certainly also benefit XRP as an asset.

9. Uniswap

Uniswap is a decentralized cryptocurrency exchange that introduced and popularized the AMM (automated market maker) model. This unique design removes the need for order books, providing an elegant way for swapping between different tokens directly on the blockchain without relying on intermediaries.

The Uniswap protocol is decentralized, and anyone can create liquidity pools for any token. This means that the newest crypto assets are often traded on Uniswap before they make their way on centralized cryptocurrency exchanges.

The model introduced by Uniswap has been adopted by many decentralized exchanges on different blockchain platforms. However, Uniswap remains the most active decentralized exchange in terms of trading volume.

Uniswap is governed by holders of the UNI token, who can submit and vote for proposals. UNI was distributed to past users of the Uniswap protocol via an airdrop in 2020, and the token is now available for purchase on a variety of both decentralized and centralized trading platforms.

Why Uniswap?

Uniswap’s governance token UNI has been the best performer among the top 100 cryptocurrencies in the past week, recording a +12% price 12. This surge has helped UNI reach a new multi-week high during a period where the overwhelming majority of cryptocurrencies lost value.

On-chain data reveals that UNI's price increase coincided with promising market trends. The open interest for UNI peaked at $168 million earlier in June, up from $85 million a month ago, indicating growing investor interest. While this does not guarantee that UNI will continue to rise in value, it suggests that investors are optimistic about its prospects.

On June 14, Uniswap announced support for ZKsync, enabling trades on the highly efficient Ethereum layer 2 network. This integration promises lower fees and faster transaction times for Uniswap users, potentially contributing to the recent positive sentiment around UNI.

You asked. We answered.

ZKsync is now live on the Uniswap interface 🔄 pic.twitter.com/fIZscDTe8b

— Uniswap Labs 🦄 (@Uniswap) June 14, 2024

10. Cosmos

Cosmos is a network that’s designed to allow different blockchain platforms to interoperate with each other. The Cosmos network is coordinated by the Cosmos Hub, a Proof-of-Stake blockchain. The Cosmos Hub is also designed to facilitate connections with blockchains outside of the Cosmos ecosystem, for example Bitcoin and Ethereum. The different blockchains that make up Cosmos communicate through a protocol called IBC (Inter-Blockchain Communication).

The Cosmos Hub and other blockchains in the Cosmos network are built using the Cosmos SDK framework. Blockchains launched on Cosmos benefit from a robust Proof-of-Stake consensus mechanism, fast transaction times (about 7 seconds) and low transaction costs (about $0.01 per transaction).

The native asset of Cosmos is called ATOM. Users can stake their ATOM tokens to contribute to the network’s security as well as earn staking rewards and a portion of the transaction fees collected by the network.

Why Cosmos?

The Cosmos community has approved a proposal to cap the inflation rate of the ATOM token at 10%. The current inflation rate is at about 14%, while the cap is set at 20%. Once enacted, the proposal will reduce the amount of new ATOM tokens entering circulation. However, it will also reduce the APR of staking ATOM tokens from about 19% to roughly 13.4%.

According to the proposal, research indicated that the Cosmos Hub blockchain is currently overpaying for its security. The proposal also argues that reducing the inflation of ATOM could have a positive influence on decentralized finance protocols and money markets in the Cosmos ecosystem.

The vote was quite contentious, as the "Yes" option received 41.1% of the vote. The "No" option received 31.9% of the vote, the "Veto" option received 6.6%, while the remaining 20.4% of the votes were for the "Abstain" option. Interestingly enough, this proposal saw the highest voter turnout in the history of the Cosmos ecosystem.

11. Shiba Inu

Shiba Inu is a meme cryptocurrency that was launched in 2020 by a person using the pseudonym “Ryoshi”. The project is heavily inspired by the Dogecoin cryptocurrency, and also features the Shiba Inu dog breed in its branding. In contrast to Dogecoin, which has its own blockchain, Shiba Inu is issued on the Ethereum blockchain as an ERC-20 token.

During the SHIB token launch, half of the supply was sent to Ethereum founder Vitalik Buterin (who is not involved with the project in any way). The project framed this as a token burn. Buterin did eventually burn the vast majority of his SHIB holdings and sold the rest of his tokens to fund charitable donations.

SHIB saw a significant spike in popularity in 2021 and became the second-largest meme coin by market cap, second only to Dogecoin. In addition, SHIB is one of the most popular penny cryptos at the moment.

Why Shiba Inu?

The Shiba Inu project has raised $12 million in funding by selling TREAT tokens. This funding was provided by a group of international venture capital firms, including Mechanism Capital, Big Brain Holdings, and others.

TREAT, which is designed to be the final token introduced in the Shiba Inu ecosystem, and it will be used as the utility and governance token of a new blockchain which is designed to improve the privacy of blockchain transactions.

The Shiba Inu ecosystem’s new blockchain will take advantage of Fully Homomorphic Encryption (FHE) technology provided by Zama. The blockchain will function as a layer 3, built on top of the Shibarium platform.

Shytoshi Kusama, the lead developer of the Shiba Inu project, had the following to say about the funding round:

“We are excited to gain the support of such powerful VCs, angel investors, and brands as we plow towards the completion of this grand decentralized experiment. Through the involvement of these venture capital firms and their strategic partners, we are expanding not only our network of trusted partners but also exponentially increasing what Shiba Inu can truly be capable of for our community, The ShibArmy.”

12. Arbitrum

Arbitrum is one of the leading layer 2 scaling solutions for Ethereum. It utilizes optimistic rollups technology to provide much faster and cheaper transactions while still leveraging the security of the Ethereum mainnet.

There are two main platforms in the Arbitrum ecosystem - Arbitrum One and Arbitrum Nova. Arbitrum One uses the fully trustless Rollup protocol, while Arbitrum Nova uses the mostly trustless AnyTrust protocol. The main distinction between the Rollup and AnyTrust protocols is the data availability committee (DAC), which is required for the AnyTrust model to function.

Arbitrum has a governance token called ARB, which is an ERC-20 token that enables holders to participate in the Arbitrum DAO and vote on key decisions related to the Arbitrum One and Arbitrum Nova blockchains.

Why Arbitrum?

The governance platform of Arbitrum has approved a proposal to allocate 225 million ARB, worth approximately $215 million, over three years to support gaming projects on the network. The proposal received over 75% of ARB token votes in favor.

The GCP has been approved by Arbitrum DAO 🔓

Arbitrum is the home of gaming – this includes all of the games, the gaming chains, and all of the builders within its orbit.

Let's make some magic happen 🎮 pic.twitter.com/QqWD1MmkdD

— Treasure (@Treasure_DAO) June 7, 2024

The proposal aims to allocate the ARB tokens to the Gaming Catalyst Program, or CGP for short. The program aims to boost the awareness and adoption of the Arbitrum ecosystem by both players and developers in the gaming community.

A large portion of the fund is reserved for publishers. New and early-stage developers can apply for grants up to 500,000 ARB, while already established developers will have to apply for investments that include offering tokens or equity to investors. The rest of the funds will be used for infrastructure and operational expenses.

Native asset

Launched in

Description

Market cap*

Bitcoin

BTC

2009

Decentralized peer-to-peer cryptocurrency

$1.24 trillion

Fetch.ai

FET

2019

Leading AI-focused crypto project

$3.02 billion

Ethereum

ETH

2015

The leading blockchain for smart contracts

$418 billion

Solana

SOL

2020

High-performance blockchain for smart contracts

$66.4 billion

Kaspa

KAS

2021

Scalable layer1 blockchain based on BlockDAG architecture

$4.2 billion

BNB

BNB

2017

BNB Chain's native asset and token used in Binance ecosystem

$85.4 billion

Toncoin

TON

2021

A blockchain closely integrated with the Telegram messenger

$26.4 billion

XRP

MATIC

2012

Highly efficient digital currency

$26.6 billion

Uniswap

UNI

2020

The biggest decentralized exchange protocol

$5.5 billion

Cosmos

ATOM

2019

A network of interconnected blockchains

$2.6 billion

Shiba Inu

SHIB

2020

The second-largest meme coin on the market

$10 billion

Arbitrum

ARB

2021

The top layer 2 solution for Ethereum

$2 billion

*Data as of July 8, 2024, at 10:00 UTC.

Best crypto to buy for beginners

If you're a new entrant in the cryptocurrency space, it's probably best to stick to cryptocurrencies that have been around for a longer period of time and have a well-developed ecosystem of resources for users. This will make it easier for you to set up your wallet and find answers if you encounter any problems along the way.

If you're a beginner, consider sticking to cryptocurrencies that satisfy the following criteria:

The coin has a significant market capitalization ($1 billion and up)

The coin is listed on many cryptocurrency exchanges and can easily be exchanged against fiat currencies

The coin has solid liquidity (at least $100 million in 24-hour trading volume)

The coin is already a working product and is not based on future promises

If you stick to coins that meet these criteria, you'll automatically be filtering out a lot of low-quality projects and reducing your chances of falling victim to scams. You will also easily be able to sell your coins and convert them to fiat currency if you ever decide to do so.

Here are a few examples of cryptocurrencies that are worth considering for beginner investors in crypto. These coins have a lot of liquidity, well-developed ecosystems and a lot of educational resources and tools that will help beginners get up to speed.

Bitcoin

Ethereum

Litecoin

Polygon

Solana

Please note that cryptocurrencies are risky investments and typically display a lot of price volatility. This is true even for established cryptocurrencies with multi-billion dollar market capitalizations. Never invest more than you are willing to lose.

Best crypto to buy for long-term investors

Many crypto investors prefer to passively hold their cryptocurrencies over the long term instead of actively trading them. Frankly, this is a good decision if you don't want to put a lot of time and effort into following everything that's happening in the crypto and blockchain space.

If you're trying to invest in crypto for the long term, we recommend that you only stick to the most established cryptocurrencies such as Bitcoin and Ethereum. While they are still risky, their fundamentals are much more robust than projects that heavily depend on just a few developers and community leaders.

In order to invest in crypto successfully over the long term, we recommend that you store your coins safely using a hardware crypto wallet. Although there are plenty of high-quality hardware wallets out there, Ledger's devices stand out as the best choice overall, in our opinion.

Get a Ledger Hardware Wallet

How we chose the best cryptocurrencies to buy

With thousands of different cryptocurrencies on the market, it can be challenging to narrow down the list to only about a dozen coins. When creating this list, we aimed to showcase a variety of cryptocurrency projects, ranging from well-established projects to more speculative projects that could potentially have a lot of upside. Here are the factors we considered when deciding which cryptocurrencies to feature.

Availability

It's important for a cryptocurrency to be easily available across a variety of cryptocurrency exchanges, including both centralized and decentralized options. We also considered whether the cryptocurrency can be traded directly against fiat currencies, which makes the process of buying and selling much more straightforward.

Market capitalization

The coins featured on our list of the best cryptocurrencies to buy in 2023 are all among the 100 largest crypto assets by market capitalization. By itself, a large market capitalization doesn't mean that the project is of high quality. However, it is a good indication that there's a lot of community interest in the project, and coins with a larger market cap are more resilient to market manipulation attempts, as moving the market requires large amounts of capital.

Sector leadership

The cryptocurrency market can be divided into several sectors. For example, we have Proof-of-Work cryptocurrencies and Proof-of-Stake cryptocurrencies, which represent two of the main approaches towards achieving decentralized consensus. We can further identify other sectors such as decentralized finance, non-fungible tokens, layer 2 projects, meme coins and others.

We attempted to highlight projects that are leaders in their respective sectors in order to showcase the variety that can be found in the crypto and blockchain space.

Working products

It's important that the cryptocurrency we're featuring has a working product already and isn't simply based on future promises. When it comes to cryptocurrencies, we generally avoid highlighting coins that don't have a working mainnet yet. When it comes to tokens, we try to focus on tokens that are used as utility tokens in a working product or as governance tokens in an actively used decentralized protocol.

Occasionally, we will highlight coins that are about to launch their mainnet or key product soon. However, we try to limit this only to top-tier projects that are highly anticipated by the crypto community.

Team and development

Most high-quality crypto and blockchain projects are transparent about their team and their credentials. We prefer to highlight projects developed and managed by highly qualified individuals. In addition, we put a lot of value on activity. If a project is being developed actively, we're much more likely to feature it over a project that is only improved occasionally.

Of course, a project's team or founders being anonymous is not a dealbreaker in every single case. After all, we still don't know who created Bitcoin.

The bottom line: What crypto to buy now?

What is the best crypto to buy now is mostly dependent on your own individual risk profile and investment goals. If you are interested in cryptocurrencies that have long-term potential, then staples like BTC and ETH are probably the right choice for you.

If your risk appetite is greater, you can try to pursue investments in cryptos under 1 cent or participate in the latest crypto presales if you are feeling especially frisky.

In any case, please keep in mind that the cryptocurrency market is highly volatile and that investing in cryptocurrency is subject to considerable risk. Always do your research and consider your financial situation before making any investment, and never invest more than you are willing to lose.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings