Ethereum Bloodbath: Over $55 Million In Longs Liquidated As Price Plummets

The recent price action of Ethereum has not been so much of a breeze. The second-largest cryptocurrency by market cap experienced a surge that nearly reached its all-time high, only to be met with a sharp reversal, leaving long traders licking their wounds.

Bulls Take A Hit, But Sentiment Remains Positive

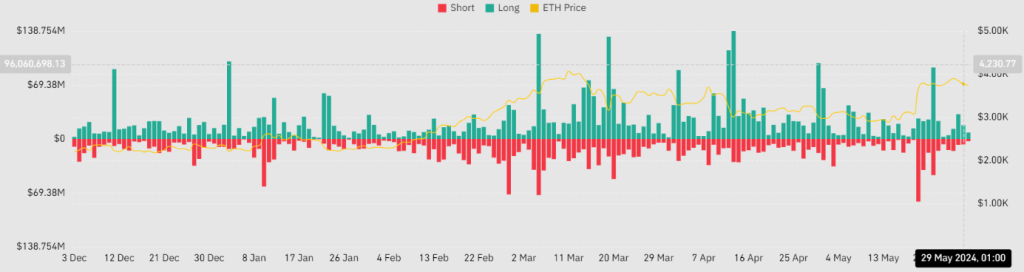

The past few days have seen a significant decline in Ethereum’s price, dropping from $3,880 to around $3,735. This has resulted in substantial liquidations for long traders, exceeding $55 million in the last three days compared to only $16 million for short positions.

Despite the dip, technical indicators paint a bullish picture. The price remains above the short moving average, and the Relative Strength Index (RSI) sits comfortably above 60, suggesting a strong underlying trend.

The funding rate, which reflects the cost of borrowing and lending cryptocurrency, provides further evidence of bullish sentiment. It has remained positive, currently at 0.014%, suggesting that buyers are still dominant and expect the price to rise further.

Open Interest Soars, Signaling Sustained Investor Interest

While the price has dipped, investor interest in Ethereum remains robust. Open Interest, which reflects the total amount of outstanding futures contracts, reached a peak of $17 billion on May 28th, the highest level in over a year. This indicates that despite the recent volatility, investors are still heavily engaged with Ethereum and believe in its long-term potential.

Ethereum Price Forecast

Meanwhile, Ethereum’s current price prediction of $3,940 by June 30th suggests a potential 2% increase. While the technical indicators remain neutral, the high Fear & Greed Index of 73 indicates a prevailing sense of greed among investors. This could fuel further price movement in the short term.

Looking at the recent performance, Ethereum has experienced a moderate amount of volatility with 57% green days over the past month. This suggests a potential for continued upward momentum, especially considering the significant price increase since the cycle low of $897. However, it’s important to remember that the market is dynamic, and corrections can occur even in bullish environments.

Related Reading: Political Memecoin Mania: Super Trump Token Explodes With 200% Surge

Overall, the technical analysis paints a mixed picture for Ethereum. While the neutral sentiment and recent price dip might raise some concerns, the high Fear & Greed Index and strong performance since the cycle low suggest potential for further growth.

Featured image from Pexels, chart from TradingView

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings