Bitcoin Crash: Here’s What The Data Says About Buying The Dip

The on-chain analytics platform Santiment has provided useful insights for investors considering buying the Bitcoin dip. The platform suggested that the worst might not be over as the flagship crypto could still experience further dips from its current price range.

To Buy Or Not To Buy The Bitcoin Dip?

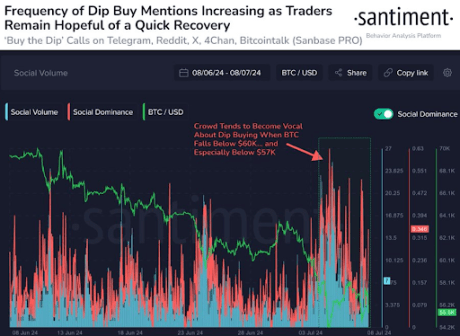

In an X (formerly Twitter) post, Santiment mentioned to those considering buying the dip that market participants also anticipate a rebound. They added that these dramatic dips, like the one Bitcoin recently experienced, are usually met with FUD (Fear, Uncertainty, and Doubt).

This suggests that those looking to buy the Bitcoin dip may have to be careful as Bitcoin could dip further due to those waiting to offload their holdings out of panic once the flagship crypto recovers. Regarding FUD, there have also been calls that Bitcoin could still drop to the $40,000 range. As such, such statements could prove bearish for Bitcoin’s price, causing it to further decline.

Meanwhile, Santiment noted that Bitcoin usually recovers from such dramatic dips after the average trader has given up hope on crypto. Crypto analyst CrediBULL Crypto also had some words for those looking to buy the dip at Bitcoin’s current price range. He mentioned in an X post that anyone looking to buy at these current price levels must be okay with being “underwater” for a while.

He added that anyone uncomfortable with being underwater for a while should wait until some positive price action develops. He noted that this positive price action could ideally come in the “form of a major liquidation flush (open interest reset) or some LTF impulsive price action.”

The crypto analyst also addressed spot Bitcoin buyers. He assured them that they need not worry about this current price range, claiming that Bitcoin could drop lower on the higher time frame (HTF) without invalidating the HTF bullish structure. Based on Bitcoin’s bullish structure, he mentioned that the price correction following this downtrend will send the flagship crypto to $100,000.

Institutional Investors Are Buying The Dip

Recent data from Farside investors shows that institutional investors are buying the Bitcoin dip. On July 8, the Spot Bitcoin ETFs recorded total net inflows of $294.8 million. BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s GBTC all recorded impressive net inflows of $187.2 million, $61.5 million, and $25.1 million, respectively.

These Spot Bitcoin ETFs also recorded net inflows of $143 million on July 5, which marked a turnaround considering that they had experienced two consecutive days of outflows before then. These inflows into Bitcoin have contributed to the recent price rebound that the flagship crypto has witnessed.

At the time of writing, Bitcoin is trading at around $57,100, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings