US Inflation Rate Plummets to 2.4% Amid Tariff Pause—What’s Next for Markets?

Markets and Prices

Jamie Redman

US Inflation Rate Plummets to 2.4% Amid Tariff Pause—What’s Next for Markets?

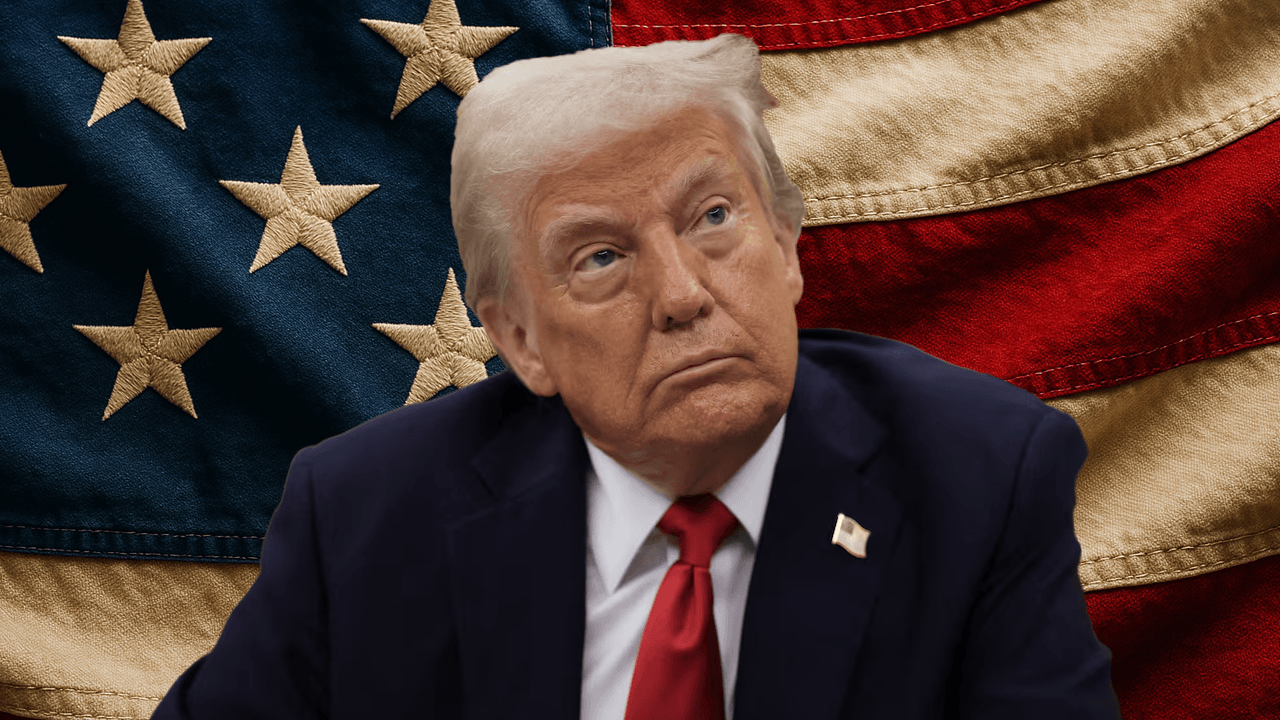

The U.S. inflation rate notably slipped in March, bringing the 12-month inflation rate down to 2.4% from its February standing of 2.8%. This development arrives in advance of the May Federal Reserve meeting and coincides with President Donald Trump’s announcement this week of a 90-day suspension of some tariffs.

US Inflation Rate Plummets to 2.4% Amid Tariff Pause—What’s Next for Markets?

U.S. Inflation Rate Cools, Bitcoin and Stocks Slide

Inflation appears to be moderating, as indicated by the latest Consumer Price Index (CPI), a comprehensive gauge tracking the cost of goods and services nationwide. The U.S. Bureau of Labor Statistics noted in its latest release that the CPI for All Urban Consumers (CPI-U) dipped 0.1 percent after seasonal adjustments last month, following a 0.2% uptick the prior month.

US Inflation Rate Plummets to 2.4% Amid Tariff Pause—What’s Next for Markets?

U.S. stocks opened in the red on Thursday morning.

Over the preceding year, the all-items index documented a 2.4% total rise prior to seasonal adjustments. Should inflation remain subdued, the Federal Reserve’s choice to hold rates steady hinges on multiple considerations, including its economic forecasts and dual mandate of price stability and full employment. Presently, the Fed has upheld its benchmark rate but hinted at potential reductions by 2025’s conclusion.

CME’s Fedwatch tool indicates a 79.1% probability that the U.S. central bank will leave the federal funds rate untouched in May. President Trump’s recent action to suspend some tariffs has spurred notable market gains. The European Union has elected to pause tariffs on U.S. products for 90 days and intends to engage in talks with the U.S. leader. Bitcoin remains confined to a narrow band, drifting just beneath the $82,000 threshold, while gold’s value has soared to $3,134 per ounce.

US Inflation Rate Plummets to 2.4% Amid Tariff Pause—What’s Next for Markets?

BTC/USD at 9:51 a.m. ET on April 10, 2025.

Stocks plummeted on Thursday following a historic rally on Wall Street that peaked on Wednesday afternoon. The Nasdaq opened down 483 points, the Dow Jones Industrial Average slid 750 points, and the S&P 500 slumped by 119 points fifteen minutes following the market’s opening on Thursday morning. Amid market volatility, the White House insists “inflation is down, jobs are up, and the Golden Age of America is underway.” By 9:45 a.m., bitcoin ( BTC) was struggling near the $81,000 range, following alongside the stock dump.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings