IRS Warns Sports Bettors to Wager Lawfully, Report Winnings as Taxable Income

The IRS warned sports bettors as the NFL season kicked off on Thursday night that they should only wager with legal, regulated sportsbooks and that they must report winnings as taxable income.

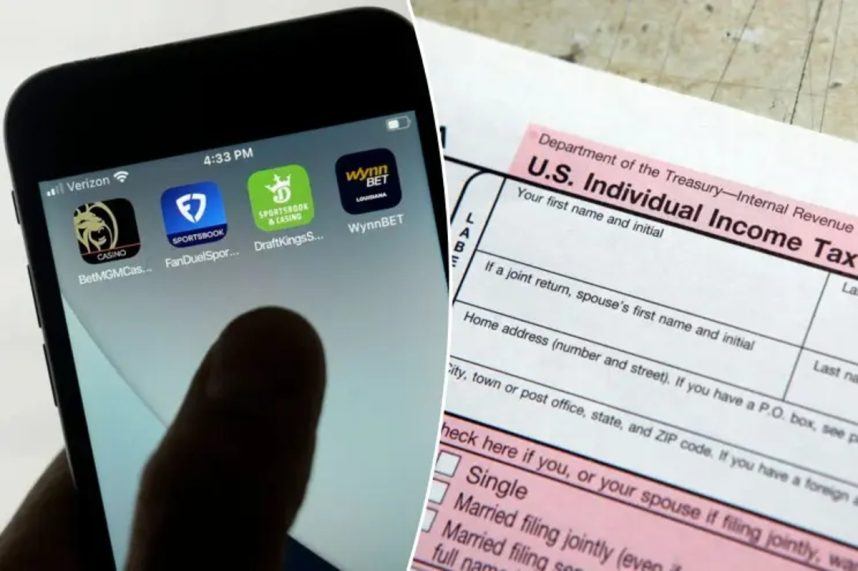

The IRS is reminding sports bettors that winnings above $600 are taxable income and must be reported on their federal returns. The IRS is targeting bettors who fail to comply. (Image: AP)

Sports betting is legal in 38 states and Washington, DC. The American Gaming Association (AGA) projects that US bettors will wager a record $35 billion on NFL games this year with regulated sportsbooks, though even more is likely to be bet through underground bookies and illegal offshore sportsbook websites.

The IRS encourages bettors to bet only with regulated operations in legal sports betting states. Those who don’t risk legal recourse, said the federal government agency responsible for collecting taxes.

Sports betting has grown exponentially in the past five years and is more common than ever. While online gambling is easily accessible, it’s not always legal,” said IRS Criminal Investigation Chief Guy Ficco.

“As this year’s football season kicks off, IRS Criminal Investigation special agents are continuing to monitor trends and using our expertise to root out criminal activity related to illegal gambling like money laundering and tax evasion,” Ficco added.

IRS Sports Betting Crackdown

In its notice urging taxpayers to play by the rules when it comes to sports betting, the IRS says it was behind exposing Ippei Mizuhara’s sports betting scandal earlier this year.

Mizuhara was the interpreter for Major League Baseball superstar Shohei Ohtani. The tax agency said it worked with Homeland Security investigators to uncover Mizuhara’s illegal sports betting with an illegal bookmaking operation that resulted in the interpreter stealing almost $17 million from Ohtani.

The IRS said that in June 2023, it also uncovered two men in Ohio who were running a multimillion-dollar underground sports betting ring. Those individuals were successfully prosecuted and sentenced to 21 and nine years in prison, respectively.

The IRS isn’t only focusing on multimillion-dollar infractions. Any taxpayer who violates reporting requirements can face legal recourse.

Sports enthusiasts who are unsure about their tax obligations or have questions about reporting gambling income are encouraged to consult tax professionals or visit the official IRS website for guidance. Ignorance of the tax law does not exempt individuals from their responsibilities,” the notice read.

The IRS Criminal Investigation Unit has 20 field offices across the country. The agency is responsible for conducting financial crime investigations, including tax fraud. It’s the only federal law enforcement agency with investigative jurisdiction over violations of the Internal Revenue Code.

Tax Requirements

The IRS requires that gamblers report their winnings above certain thresholds on form W-2G. Nerdwallet, an online personal finance website that provides tax tips, says bettors who win $600 or more in a tax year must report the money as taxable income on their federal return.

The payout has to be 300 times the amount risked to mandate reporting. Sports betting losses can be deducted against the $600 winning threshold should the filer itemize their return.

Filers who fail to accurately report their sportsbook winnings risk criminal charges ranging from money laundering to tax evasion.

The post IRS Warns Sports Bettors to Wager Lawfully, Report Winnings as Taxable Income appeared first on Casino.org.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings