Advanced Micro Devices Inc. (NASDAQ:AMD) the Hottest Large-Cap Stock Right Now?

Reymerlyn Martin

In This Article:

AMD

+3.93%

We recently compiled a list of the 10 Hottest Large-Cap Stocks Right Now. In this article, we are going to take a look at where Advanced Micro Devices Inc. (NASDAQ:AMD) stands against the other large-cap stocks.

This article will analyze several prominent large-cap stocks that are currently exerting significant influence on market dynamics. These stocks are currently considered "hot" because their stock prices are relatively more volatile, and they draw the attention of a large pool of investors. These stocks are the most talked about, with high trading volumes, large price actions and overall hot atmosphere surrounding them currently.

What to watch when it comes to Large-Cap Stocks?

Large-Cap Stocks are usually household names, stocks which even the non-investing population has heard of. They are considered safer investments than small-cap stocks, so they will naturally bring a larger volume when it comes to trading.

Price change over the past week is the first parameter we will analyze when talking about the hottest Large-Cap Stocks. Another parameter which we will analyze is the volume of shares traded over the course of the past trading week. Even with Large-Caps, when investors and traders see large changes in volume, they could get spooked or could see an opportunity to jump in and aboard the train.

The first days of the new year, as well as the last days of the year gone, are usually very volatile. There are a lot of speculation and tax-loss harvesting going on, which affects the broader market dynamics. On the other hand, investors who took profit in 2024 are looking for new investments to start their new investment year strong. The New Year's Day holiday also affects the trading continuity, further deepening the volatility. To see which firms kicked this year off in the red, you can check out the following article.

The Large-Caps listed here are all market titans, with market caps over $200 billion dollars.

AMD (AMD): Competing with Giants and Facing Market Realities

AMD (AMD): Competing with Giants and Facing Market Realities

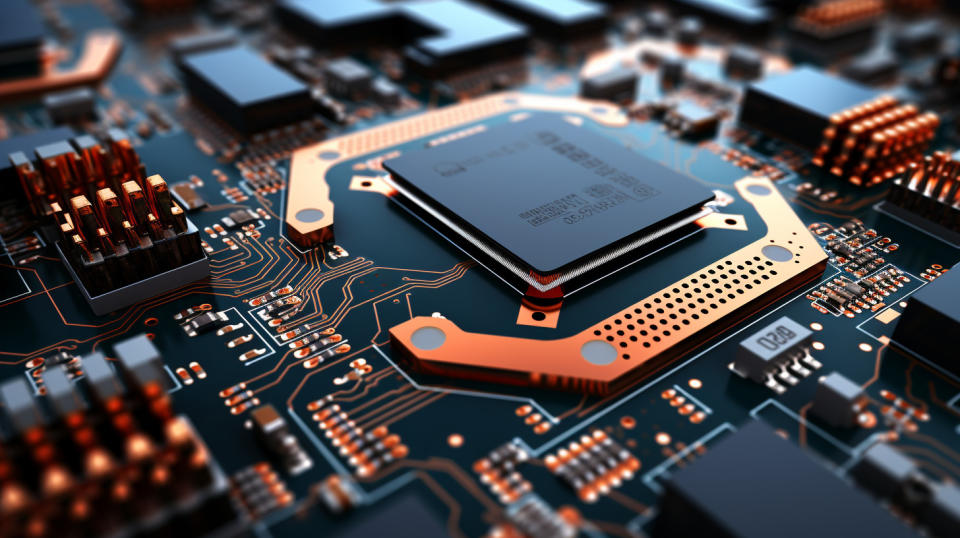

A close up of a complex looking PCB board with several intergrated semiconductor parts.

Advanced Micro Devices Inc. (NASDAQ:AMD)

Return: 0.8%

Shares of Advance Micro Devices ended this week 0.80% in green, compared to the previous week. The volume of shares traded was between 30 and 34 million, with constant selling pressure. A slight dip in the share price provided a buying opportunity, resulting in an immediate recovery and possible trend reversal.

This price action was followed with a nice volume of 36.7 million shares traded. The future looks bright for the whole AI sector as well as the semiconductor industry, and since AMD stock is positioned 19th in the list of the 30 most popular stocks among hedge funds, there is no doubt that AMD will come closer to its recent 2024 highs. Northland Capital agrees with this view:

"Northland Capital rated AMD as Outperform with a price target of $175, highlighting more upside than risks for 2025. AMD is projected to gain market share in AI GPUs, server CPUs, and PCs as challenges in embedded and gaming segments ease. AI revenue is estimated to grow from $5.2 billion in 2024 to $9.5 billion in 2025, with the MI325X competing well against Nvidia. In server CPUs, AMD’s Turin chips are expected to outperform Intel’s Granite Rapids, with non-AI data center revenue projected at $8.5 billion in 2025. In PCs, AMD may benefit from increased demand as Windows 10 support ends, potentially driving client revenue beyond $9 billion. The firm said:

“AMD remains one of our top picks for calendar year 2025. We anticipate AMD will continue gaining market share in AI GPUs, server CPUs, and PC clients as the headwinds from embedded and gaming segments subside. AMD’s AI strategy is driven by its roadmap and Total Cost of Ownership (TCO) advantages, while its server and client CPU products outperform competitors. The PC refresh cycle could be stronger than current expectations, presenting significant upside to calendar year 2025 estimates.”

Overall AMD ranks 2nd on our list of the hottest large-cap stocks. While we acknowledge the potential of AMD as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AMD but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings