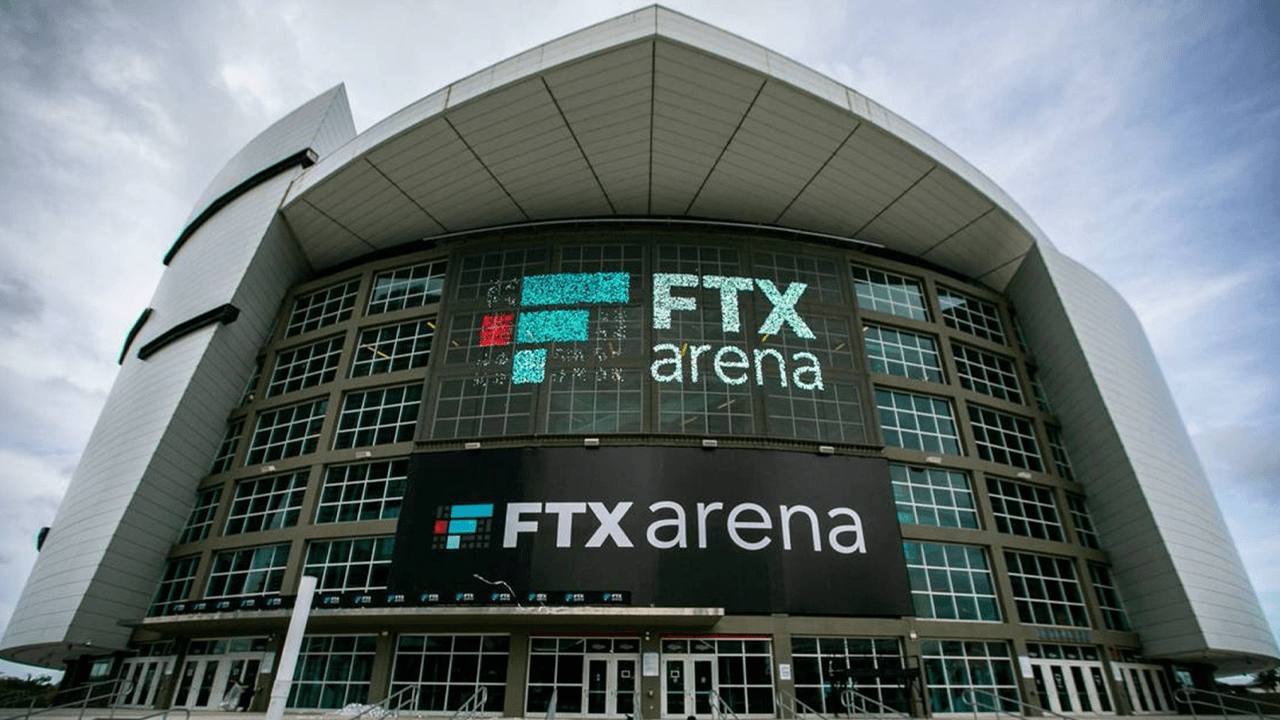

FTX Creditors to Receive Over $5B in Second Payout Starting May 30

Crypto News

Jamie Redman

FTX Creditors to Receive Over $5B in Second Payout Starting May 30

The FTX Recovery Trust explained on Thursday that it will distribute more than $5 billion to creditors starting May 30, 2025, as part of its court-approved Chapter 11 bankruptcy reorganization plan.

FTX Creditors to Receive Over $5B in Second Payout Starting May 30

Distribution Date Set for FTX’s $5B Creditor Repayment

The distribution, the second under FTX’s reorganization plan, will pay creditors across multiple claim classes. Class 5A (Dotcom Customer Entitlements) will receive 72% of claims, while Class 5B (U.S. Customer Entitlements) will get 54%. Classes 6A (General Unsecured Claims) and 6B (Digital Asset Loan Claims) will each receive 61%.

Alongside this, Class 7 (Convenience Claims) will recover 120%, according to bankruptcy filings. Plan Administrator John J. Ray III called the payout a “milestone,” citing the scale of creditor coordination. “These first non-convenience class distributions are an important milestone for FTX,” Ray remarked.

Eligible creditors must have completed Know Your Customer (KYC) verification, tax forms, and onboarded with Bitgo or Kraken, FTX’s two designated distribution partners. FTX explained that transferred claims require processing 21 days before record dates.

FTX claimants in the bankruptcy proceedings will not recover their original crypto holdings but will instead receive cash equivalents pegged to the value of those assets as of November 2022. This timing proved unfavorable for creditors, as cryptocurrency valuations had plummeted to significant lows during that period.

The company warned of phishing scams mimicking its customer portal, emphasizing it will never request wallet connections. The notice said, future distribution dates and requirements will be posted on the FTX Customer Portal and court dockets. Bankruptcy documents, including the reorganization plan, remain accessible via the U.S. Bankruptcy Court’s claims portal.

FTX’s pre-bankruptcy exchange token FTT gained 12% on the news, maintaining its price above the $1 threshold. As of this update, FTT trades at $1.26—a staggering 98.5% decline from its 2021 peak of $84.18. Much like the token celsius network (CEL), the token stubbornly retains market value despite the absence of any substantive backing, leaving observers to ponder the peculiar resilience of speculative assets.

Jamie Redman

XRP Price Watch: Bulls Charge as XRP Climbs to $2.57 Amid Rising Market Cap

XRP is currently trading between $2.54 and $2.57 over the last hour, with a market capitalization of $150.38 billion. Over the past 24 hours, it has seen a trading volume of $5.6 billion and an intraday price range between $2.52 and $2.63.

XRP Price Watch: Bulls Charge as XRP Climbs to $2.57 Amid Rising Market Cap

XRP

On the 1-hour chart, XRP’s bullish momentum shows signs of exhaustion, despite the recent upward movement. After peaking at $2.651, the price action has been marked by consecutive red candlesticks and declining volume, which signals a potential short-term retracement. The appearance of a bearish divergence—indicated by lower volume accompanying tests of similar price levels—suggests a cooling phase. Traders may find opportunities by watching support around $2.55–$2.57; however, a break below $2.54 may lead the price to test the $2.50 level rapidly, warranting caution for short-term positions.

XRP Price Watch: Bulls Charge as XRP Climbs to $2.57 Amid Rising Market Cap

XRP/USDC 1H chart via Binance on May 14, 2025.

The 4-hour chart presents a sustained uptrend, although early signs of waning momentum are apparent. Price action following a large bullish candle has transitioned into a series of indecisive candlesticks, potentially forming a bullish flag or signaling the beginning of a distribution phase. A notable upper wick rejection at $2.656 illustrates heightened selling pressure near that resistance. As long as XRP holds above $2.50, the medium-term bullish structure remains intact. Entries near the $2.45–$2.50 range could present favorable risk-reward setups, while a confirmed breakout above $2.66, supported by increased volume, could validate a continuation to higher price targets.

XRP Price Watch: Bulls Charge as XRP Climbs to $2.57 Amid Rising Market Cap

XRP/USDC 4H chart via Binance on May 14, 2025.

The daily chart analysis highlights a strong bullish breakout that recently propelled XRP past former resistance levels around $2.30, reaching a high of $2.656. A substantial surge in buying volume validated the upward move, although the current formation of small-bodied candles reflects indecision and potential consolidation near the recent peak. Key support levels now lie at $2.30 and $2.10, which previously acted as resistance. A strategic entry point for swing or position traders would be on dips toward the $2.30–$2.40 range, especially if volume confirms a bounce. A decline below $2.10 would compromise the broader bullish structure and suggest a deeper correction.

XRP Price Watch: Bulls Charge as XRP Climbs to $2.57 Amid Rising Market Cap

XRP/USDC 1D chart via Binance on May 14, 2025.

The oscillator indicators provide a mixed outlook. The relative strength index (RSI) at 67.92130 and Stochastic at 84.12581 both remain in neutral zones, indicating neither overbought nor oversold conditions. The commodity channel index (CCI) at 180.06346 signals a potential sell, suggesting prices may be extended above their mean. Meanwhile, the average directional index (ADX) at 21.30462 also shows neutrality, lacking a strong trend confirmation. Positive momentum is observed with the momentum reading at 0.41380 and the moving average convergence divergence (MACD) level at 0.09519, both suggesting ongoing buying interest.

All moving averages continue to support a bullish stance. Both the exponential moving averages (EMA) and simple moving averages (SMA) for the 10, 20, 30, 50, 100, and 200 periods indicate bullish signals. Specifically, the exponential moving average (10) stands at $2.41372, and the simple moving average (10) is at $2.36197, both sitting below the current price, reinforcing the short-term bullish outlook. Long-term indicators such as the exponential moving average (200) at $2.02880 and simple moving average (200) at $2.14926 reflect strong underlying support for XRP, aligning with the uptrend visible on higher timeframes. This unified bullish consensus across moving averages underscores a robust trend continuation scenario, barring significant macro or technical disruptions.

Bull Verdict:

XRP’s consistent support across all major exponential and simple moving averages, alongside bullish momentum signals from the moving average convergence divergence (MACD) and momentum indicators, underpins a strong technical foundation for further gains. If buying volume resurfaces on dips and resistance at $2.66 is decisively broken, XRP could accelerate toward $2.70 and beyond, validating a continuation of the uptrend.

Bear Verdict:

Despite the bullish trend on higher timeframes, warning signs on the 1-hour and 4-hour charts—such as bearish divergence, declining volume, and resistance rejection at $2.656—suggest a possible near-term pullback. A failure to hold support at $2.50 and especially a breach below $2.45 would likely trigger a deeper correction, potentially challenging the $2.30 level and undermining the current bullish structure.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings