Crypto Winners and Losers from Q2 Revealed, as Meme Coins Falter

It’s been another dramatic quarter for crypto, with news coming in left, right, and center. Here’s just a flavor of the top headlines between April and June:

The long-awaited Bitcoin halving took place in April, meaning just 450 new BTC are entering circulation every day, but still suffered its worst month since FTX collapsed.

Terraform Labs and embattled co-founder Do Kwon were found guilty of fraud and fined an eye-watering $4.47 billion, with the company set to close for good.

Frenzied activity in the meme coin space gained momentum, with more than one million new tokens launched in just six weeks on Ethereum and Solana.

FTX customers reacted furiously as it was announced how they would be compensated — with Sam Bankman-Fried appealing his sentence from behind bars.

Binance’s Changpeng Zhao was handed a four-month prison sentence for money laundering violations, which some critics described as a ‘slap on the wrist.’

The Securities and Exchange Commission gave the green light to a flurry of exchange-traded funds based on Ether’s spot price

Fears of Bitcoin sell-offs by the German government and Mt. Gox creditors began to spook the market.

Overall, BTC shed almost 12% of its value in Q2 of 2024 as it struggled to build upon the fresh all-time high of $73,686.93 seen in the middle of March. The world’s biggest cryptocurrency also ended up suffering its worst quarter since the last three months of 2022 as it battled to retain some bullish momentum.

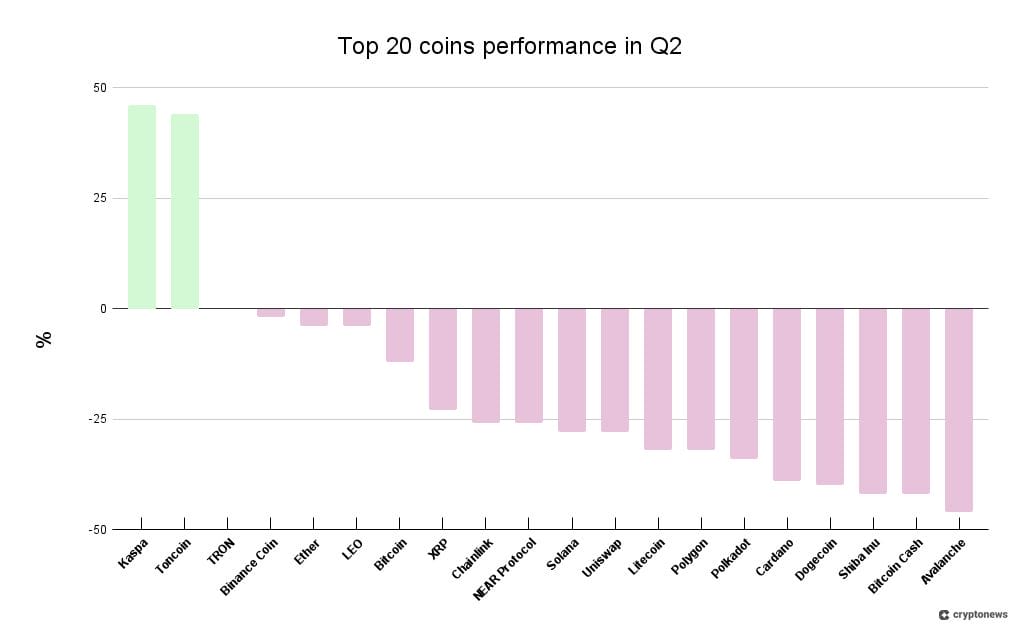

Here’s how the top 20 coins by market cap (excluding stablecoins and wrapped coins) fared in Q2:

Data source: Coinpaprika

It’s interesting to see such a mixed bag of fortunes among the biggest altcoins — and pretty staggering that Avalanche lost 46% of its market cap in the space of just three months. This is likely a reflection of some pretty gloomy numbers over the quarter.

Data source: CoinMarketCap

Data from Coin98 Analytics on X suggests income from fees is down 53.3% year on year. What’s more, the $3.5 million earned in Q2 plummeted 53.3% in a single quarter. Average active daily addresses have dwindled to 43,480, compared with 58,870 a year ago, while there’s also been a 90.46% reduction in the number of new NFTs being created in the past 12 months.

Solana’s stomach-churning drop of 28% could be a sign that it’s now a hostage to fortune, with the native token’s future performance determined by the health of the meme coin market. With the likes of Australian rapper Iggy Azalea shilling her MOTHER token on X, and the Argentinian footballing great Lionel Messi plugging WATER on Instagram, there seems to be more attention on the flash-in-the-pan tokens being created on this blockchain than on SOL itself. Dogecoin and Shiba Inu’s declines similarly indicate that “gem hunters” have fallen out of love with older joke cryptocurrencies as they chase greater gains elsewhere.

As you can see above, there are two major altcoins that have bucked the trend — accelerating sharply despite the recent market downturn. Toncoin, which was initially developed by Telegram, has been on a tear recently. The popular messaging platform has been on a mission to become a “super app” that gives users everything they need in one place, and recent figures suggest TON has now surpassed Ethereum in terms of daily active addresses.

But the development that’s been causing the most excitement in recent months is the rise of gaming on Telegram. Arguably the most novel example is Hamster Kombat, where players furiously tap on the screen for the chance to earn in-game currency. Estimates suggest more than 150 million players have signed up… and some now have sore fingers as a result.

Kaspa actually turned out to be the best-performing altcoin among the top 20 by market cap in Q2. The little-covered cryptocurrency launched all the way back in November 2021 but has recently surged up the rankings. Described as a proof-of-work ecosystem that solves the long-standing blockchain trilemma by speeding up confirmation times and issuing one block per second, the project received a huge boost when it emerged that Marathon Digital has started mining KAS in an attempt to diversify revenues beyond Bitcoin. We could end up seeing many rivals follow suit.

Data source: CoinMarketCap

You might also be wondering why Ether was spared from the double-digit carnage seen in the crypto markets during Q2. A flurry of good news for the world’s second-largest cryptocurrency meant it surged substantially at certain points over the quarter — and ultimately lessened the impact of market-wide contractions. Not only did the SEC finally give the nod to ETH ETFs after a protracted battle, but it was announced that the regulator was abandoning its investigation into the blockchain’s switch from a proof-of-work to a proof-of-stake consensus mechanism.

Will Meme Coin Mania Continue?

The incessant buzz surrounding meme coins evokes memories of 2021 when the hype surrounding non-fungible tokens reached a crescendo before the bubble spectacularly burst. But when it comes to how the crypto markets performed between April and June, it seems this fast-moving and unpredictable sector was one of the few bright spots.

Alice Liu, CoinMarketCap’s head of research, told Cryptonews:

“Q2 was firmly a meme season, with meme coins emerging as the dominant trend in crypto. This marked a significant shift, as meme coins surpassed all other categories for the first time to become the most popular category — accounting for about 23% of page views on CoinMarketCap, with over 25 million in June.”

However, she went on to warn that there are clear signs that the type is beginning to slow down, with these coins accounting for just 15% of page views on CMC over the past two weeks — down eight percentage points. Listings have begun to slow down too, with just 12 of the 148 meme coins tracked by the data website showing positive returns over 14 days. All of this is reflected in the total market capitalization for this type of cryptocurrency, with a precipitous drop from $59.1 billion to $39.4 billion in the month to July 7. That’s a 33% fall that’ll undoubtedly be painful to inexperienced investors.

Liu also pointed out that there was “substantial growth” in the stablecoin sector between April and June, which she believes marks a shift to “fundamental projects and builders.” While the rest of the crypto sector was in retreat, digital assets pegged to the value of the U.S. dollar and other fiat currencies added 8.6% to their market cap in Q2 alone — with 13 new projects also making their debut.

What Lies Ahead in Q3?

We’re barely two weeks into the third quarter of 2024 now — and Bitcoin has been weakened out of the gate by selling pressure linked to the German government and Mt. Gox. Meanwhile, the total market cap of all cryptocurrencies has slid by more than $150 million since July began.

Liu told Cryptonews that she anticipates plenty of sideways price action in the weeks to come as the market attempts to absorb the pressure from these mass selloffs, with the U.S. also gearing up to offload tens of thousands of BTC linked to the darknet marketplace Silk Road.

But attempting to strike a brighter note, the analyst noted that the arrival of Ether ETFs could serve as a catalyst for renewed bullish activity, with providers and the SEC now engaged in a back and forth as they put the finishing touches to filings. While a lot of the excitement surrounding Bitcoin’s ETFs was priced in before they started trading, insatiable demand on Wall Street ended up propelling BTC to a new all-time high just two months after their debut on January 10. Crypto watchers will be hoping for more of the same as ETH joins the ranks, too.

The post Crypto Winners and Losers from Q2 Revealed, as Meme Coins Falter appeared first on Cryptonews.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings