Paper vs. Physical: Silver's Drop Highlights Market Imbalance Fears

Silver prices fell over 3% this week to $37.20 per ounce amid persistent allegations among investors that the market is suppressed by vast paper trading on the COMEX.

WRITTEN BY

Jamie Redman

Paper vs. Physical: Silver's Drop Highlights Market Imbalance Fears

Silver Bulls See Manipulation in Price Dip

Silver started the week at $36.98 to $37.20 per ounce, dipping just over 3% in seven days. That slip has reignited chatter among silver faithful who believe prices are kept in check by the heavy hand of “paper silver” flooding the COMEX futures market. The theory isn’t new—it’s been making the rounds for years upon years—and to date, no one’s been able to pin down solid proof either way.

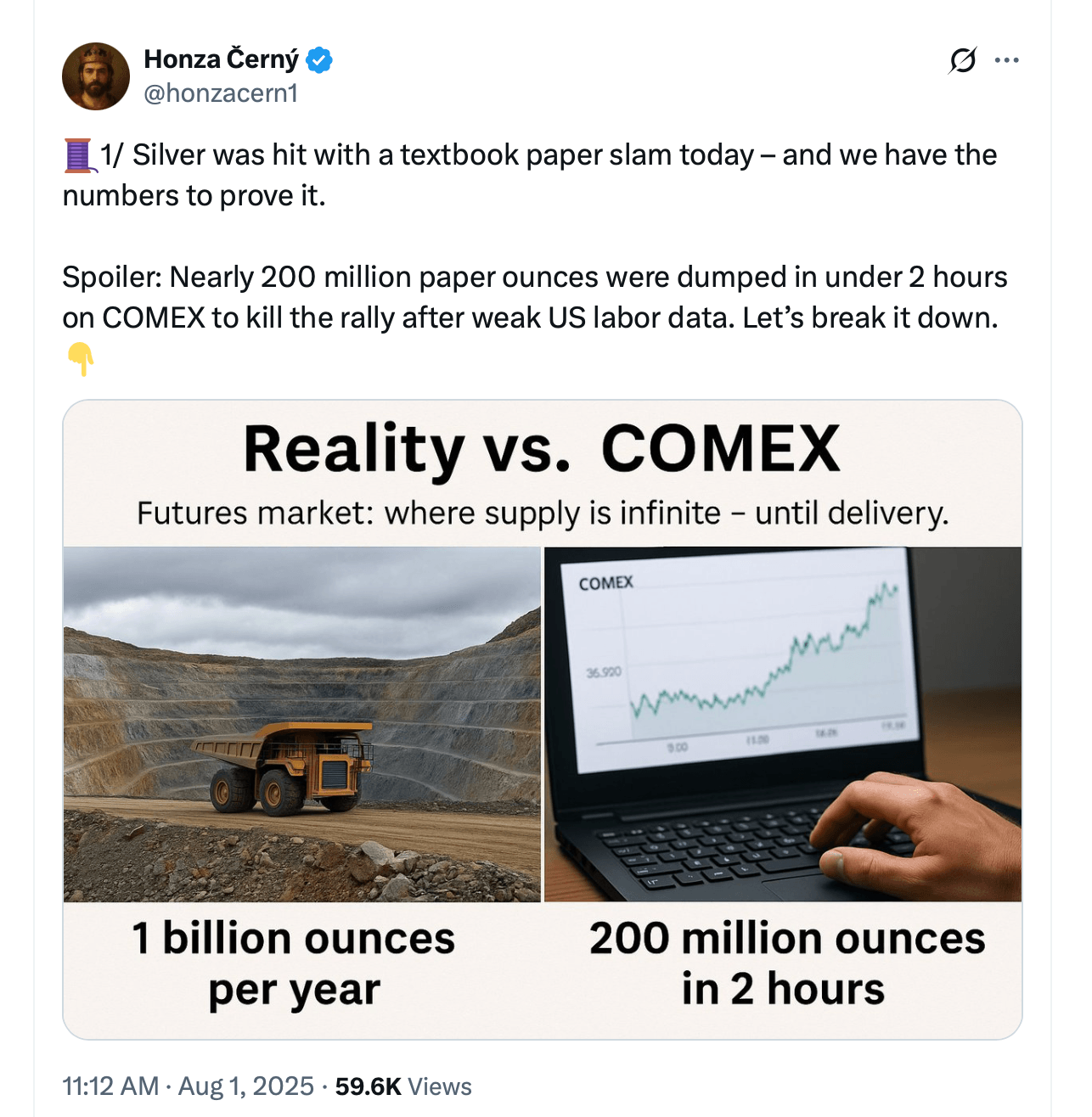

Proponents of this theory argue that the suppression hinges on a fundamental market imbalance. They cite data indicating the volume of paper silver contracts traded on exchanges like COMEX vastly exceeds annual global mine production, often by ratios claimed to be 350:1 or higher. This means hundreds of paper ounces are traded for every physical ounce mined annually.

“The silver market traded 369 million paper ounces yesterday to engineer the price lower,” claimed the X account called The Dude. “The COMEX had 918 deliveries and the LBMA had 950. Why would the price go low if this is one of the larger delivery days. Silver is 100% controlled by options and derivatives.”

Paper vs. Physical: Silver's Drop Highlights Market Imbalance Fears

Central to the theory is the role of major financial institutions, often termed “bullion banks.” Critics allege these banks hold massive short positions in silver futures contracts, sometimes unbacked by physical metal (“naked shorts”). They claim these entities strategically sell large volumes of paper contracts, particularly during periods of lower market liquidity.

Specific patterns are frequently highlighted as evidence. These include sudden, sharp price declines – termed “slams” or “tamps” – often occurring around the New York market open. Critics argue these moves are statistically improbable without coordinated selling pressure and serve to prevent silver from breaking key resistance levels.

Paper vs. Physical: Silver's Drop Highlights Market Imbalance Fears

Supporters point to historical precedents. They note major banks have faced significant regulatory fines for manipulative practices in precious metals markets, including spoofing (bogus orders) and fraud in gold and silver futures. Further cited evidence includes persistent patterns where silver prices rise during Asian and European trading hours but fall during the dominant New York session. Analysts like Ronan Manly have shared charts purporting to show this consistent suppression dynamic over decades.

The motivation behind alleged suppression, according to these theories, is multifaceted. A primary concern is protecting fiat currencies, like the U.S. dollar. Silver’s historical role as a monetary metal means a significant price surge could be interpreted as a loss of confidence in paper currencies. Keeping silver prices low is seen as bolstering this confidence.

Counterarguments and regulatory findings challenge this narrative. The U.S. Commodity Futures Trading Commission (CFTC) conducted probes into the silver market in 2008 and 2013, concluding both times it found “no evidence” of manipulation. Industry groups like the CPM Group dismiss the theories, attributing observed price patterns to normal hedging activities and industrial demand cycles.

Simultaneously, concerns about COMEX’s physical inventory persist. Data shows a significant decline in COMEX silver stocks, particularly the “registered” category available for delivery, falling sharply from early 2021 levels. The market has also seen persistent annual supply deficits for years.

The structure of the COMEX itself fuels these concerns. It operates with a fractional reserve-like system where paper claims dwarf deliverable metal. Analysts warn that sustained, high demand for physical delivery could theoretically strain or even deplete available registered silver, potentially causing market disruption.

While definitive proof of systemic, ongoing manipulation remains contested, the combination of documented past bank misconduct, observable trading patterns, declining visible inventories, and the sheer scale of paper trading provides a factual basis for why some investors consider the theories plausible. The debate intensifies with every significant price move, like this week’s latest drop.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings